Nowadays, technology is advancing rapidly. People don't carry wallets with their credit and debit cards often because they are used to making payments on their phones. This can be a safer way to carry money without worrying about being robbed.

Online payments have become very common around the world. Big tech companies like Google and Apple have created their own mobile payment systems, Google Pay and Apple Pay.

Samsung, the major Korean technology company, has also launched its own mobile payment system called Samsung Pay. In this article, we will explain all the important details about Samsung Pay.

What is Samsung Pay?

Samsung Pay is a mobile payment system that allows you to use your smartphone to pay at any retail store worldwide. Nowadays, it’s common for people to have their mobile phones in their hands most of the time, so Samsung Pay lets them to make payments without carrying their credit and debit cards around with them.

Samsung Pay: How does it work?

Samsung Pay uses NFC (Near-field communication) technology to transfer a credit or debit card’s information to an NFC-enabled payment terminal, just like how an NFC-enabled card works.

What makes Samsung Pay so remarkable is that it also works with traditional payment terminals and card machines using magnetic secure transmission (MST) technology.

What is MST?

Have you ever noticed the black magnetic strip on the back of a debit or credit card? When making payments, you swipe through a card machine or terminal, and the magnetic strip transfers your card details to the terminal.

Samsung Pay can mimic or copy that magnetic strip using a unique magnetic coil built into Samsung phones. It allows Samsung Pay to transfer your saved card details to the payment terminal, just like swiping a physical card.

This means Samsung Pay will work anywhere with a regular card machine or payment terminal. Stores don't need to upgrade their equipment for it to work, which is very convenient.

What is NFC?

NFC stands for “Near-Field Communication”, and as the name implies, it enables short-range communication between compatible devices.

How is Samsung Pay better than Apple Pay or Google Pay?

Samsung Pay's magnetic stripe technology (MST) is what makes it better than Apple Pay and Android Pay, which only use NFC technology for payments.

For NFC payments to work, the store's payment terminal must be NFC-enabled. Since many stores still need NFC terminals, Apple Pay and Google Pay can only be used in some places.

However, Samsung Pay's MST can mimic a card being swiped. This means Samsung Pay works almost anywhere that accepts regular debit or credit card payments. The store doesn't need any special NFC equipment.

Samsung says its MST technology allows Samsung Pay to work virtually anywhere traditional plastic cards are accepted for payment. This gives Samsung Pay an advantage over its competitors in terms of broader acceptance.

Is Samsung Pay safe?

Samsung Pay is more secure than carrying a physical credit/debit card. It doesn't actually store your real card number on your phone. Instead, it stores an encrypted (coded) version of your card number that gets sent to payment terminals - not your actual card number. This coded number acts like a virtual stand-in, so your real card details are never exposed.

For cards added to Samsung Pay, you don't need to create a new PIN. Your regular card PIN works when paying with Samsung Pay, so it's secure without remembering extra codes.

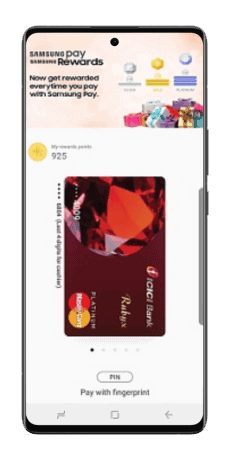

Before using Samsung Pay, you must authenticate yourself on your phone - either by fingerprint, entering your phone's PIN, or using iris scanning if your phone has that. This extra layer of security, combined with the coded card numbers, makes Samsung Pay very trustworthy and safe to use for payments while still being super convenient.

Is Samsung Pay free?

Yes, Samsung Pay is entirely free to use. In fact, Samsung gives you reward points when you use Samsung Pay to make payments. You can redeem these points for different products from Samsung Pay's retail partners.

Additionally, Samsung and its banking partners frequently offer special promotions. These can include cashback on all Samsung Pay payments or extra reward points compared to what you usually get when using your physical card.

So, not only is Samsung Pay free, but you can also earn rewards and savings by using it for your transactions instead of using a traditional card. Samsung and banks provide these bonus points and cashback offers as incentives for using Samsung Pay.

Which Country Supports Samsung Pay?

Since its first release, Samsung Pay has been gradually launching in more countries, and it is currently available in the countries listed below.

However, remember that Samsung Pay has yet to be fully rolled out in some countries, but it is expected to be available soon.

- Australia

- Brazil

- Canada

- China

- France

- Germany

- Hong Kong

- India

- Italy

- Malaysia

- Mexico

- Puerto Rico

- Russia/Belarus

- Singapore

- South Africa

- South Korea

- Spain

- Sweden

- Switzerland

- Taiwan

- Thailand

- United Arab Emirates

- United Kingdom

- United States

- Vietnam

What Banks Work with Samsung Pay in Your Country?

Not all banks in your country may support Samsung Pay yet. To find out which banks allow you to use Samsung Pay, we have provided a list below for your convenience.

Australia

- 28 Degrees Platinum Mastercard

- AMP

- ANZ

- Amex

- Australian unity

- BOQ

- Bank Australia

- Bank of Sydney

- Bendigo Bank

- Beyond Bank Australia

- Big Sky

- CITI

- CUA

- Catalyst Money

- Central Coast

- Central Murray

- Commonwealth Bank

- Community First

- Customs Bank

- Defence Bank

- Endeavour Mutual Bank

- Firefighters Mutual

- First Option

- GO Mastercard

- Holiday Coast

- Horizon

- Illawarra

- Intech

- Latitude Financial Services

- Macarthur

- NAB

- NBCU

- Nexus Mutual

- P&N Bank

- People's Choice

- Police Bank

- Police Credit Union

- Queenslanders

- RACQ Bank

- Reliance Bank

- SCU Banking

- SWSCU

- Teachers Mutual

- UniBank

- Unity Bank

- Virgin Money Australia

- WAW

- Westpac

- wecu

Brazil

- Banco Bradesco

- Banco Inter

- Banco Neon

- Banco do Brasil

- Banestes

- Banrisul

- Brasil Pre-Pagos

- Caixa Econômica Federal

- Itaú Unibanco

- Porto Seguro

- Satander

- Uniprime Norte do Paraná

Canada

- ATB

- American Express

- CIBC (Canadian Imperial Bank of Commerce)

- RBC (Royal Bank of Canada)

- Scotiabank

China

- Bank of Baoding

- Bank of Beijing

- Bank of China

- Bank of Communications

- Bank of Guangzhou

- Bank of Jiangsu

- Bank of Ningxia

- Bank of Urumqi

- CGB

- China Bohai Bank

- China CITIC Bank

- China Construction Bank

- China Merchants Bank

- China Minsheng Bank

- ChongQing Rural Commercial Bank

- Huaxia Bank

- ICBC Leshan City Commercial Bank

- Ping An Bank

- SPD Bank

- Yunnan Rural Credit Cooperatives

France

- Banque BCP

- Banque Populaire

- Banque de Savoie

- Edenred (Ticket Restaurant)

- Groupe Caisse d'épargne

- Lydia

Germany

- Visa

- Solarisbank AG

Hong Kong

- American Express

- Bank of China

- Citibank

- DBS

- Dah Sing Bank

- HSBC

- Hang Seng Bank

- Standard Chartered

Italy

- BNL (Banca Nazionale del Lavoro)

- Banca Mediolanum

- CartaBCC

- CheBanca!

- Hello bank!

- Intesa Sanpaolo

- UniCredit

Malaysia

- CIMB Bank

- Citibank

- Hong Leong

- Maybank

- Public Bank

- RHB

- Standard Chartered

Mexico

- American Express

- BanRegio

- Banorte

- Citibanamex

- HSBC

- Santander

Puerto Rico

- Banco Popular

Russia

- Agroros Bank

- Ak Bars Bank

- Alfa-Bank

- All-Russian Bank for Regional Development

- Asia-Pacific Bank

- Bank Saint Petersburg

- Bank Soyuz

- Beeline

- Binbank

- CCB

- Centrinvest

- Chelindbank

- Chelinvest

- Citi

- Credit Ural Bank

- Devon Credit Bank

- Energotransbank

- Gazprombank

- Genbank

- Home Credit Bank

- JSCB Almazergienbank

- Joint Reserve Bank

- Kurskprombank

- Kykyryza

- MTS Bank

- Minbank

- Moscow Credit Bank

- Neyva Bank

- Otkritie Bank

- PSCB

- Pochtabank

- Primbank

- Primsotsbank

- Psbank

- Raiffeisen

- Rocketbank

- RosDorBank

- Rosevrobank

- Rural Finance

- Russian Agricultural Bank

- Russian Standard Bank

- Russipoteka

- SDM Bank

- SKB Bank

- SNGB Bank

- Sberbank

- Sovcombank

- Stavropol Promstroybank

- Tinkoff Bank

- Tochka

- Ural Bank for Reconstruction and Development

- Uralsib

- VTB Bank

- Vologzhanin Bank

- Vostochny Bank

- Yandex Money

- Zenit Bank

Singapore

- American Express

- Citibank

- DBS

- FEVO

- Maybank

- OCBC Bank

- POSB Bank

- Standard Chartered

- UOB (United Overseas Bank)

South Africa

- Absa

- Standard

South Korea

- Busan Bank

- Daegu Bank

- Hana Bank

- Industrial Bank of Korea

- KB Kookmin Bank

- NH Agricultural Cooperative

- Saemaul Undong

- Shinhan Bank

Spain

- ABANCA

- Caixa Bank

- El Corte Inglés

- Openbank

- Sabadell

- Satander

- WiZink

- imaginBank

Sweden

- Circle K

- Danske Bank

- Ecster

- Eurocard

- First Card

- ICA Banken

- Nordea Bank

- Skandiabanken

- Svenska Handelsbanken

- Swedbank och sparbankern

- (SEB) Skandinaviska Enskilda Banken

- Ticket Rikskuponger

Switzerland

- ACES swisscard

- Bonus Card

- Cembra MoneyBank

- Cornercard

- Credit Suisse

- Miles & More

- Neue Aargauer Bank

- Swiss Bankers

- Swisscard AECS

- TopCard

- UBS

- VISECA

Taiwan

- CTBC

- Cathay United Bank

- Citi

- ESUN Bank

- HSBC

- Standard Chartered

- Taipei Fubon

- Taishin Bank

- Union Bank of Taiwan

Thailand

- Bangkok Bank

- Citi

- Kbank

- Krungsri Consumer

- Krungthai Card

- Siam Commercial Bank

- United Overseas Bank

- mPay Wallet

United Arab Emirates

- ADCB

- Ajman Bank

- Dubai Isliamic Bank

- Emirates Islamic

- Emirates NBD

- HSBC

- Mashreq

- NBAD

- Noor Bank

- RAKBANK

- Sharjah Islamic Bank

- Standard Chartered

United Kingdom

- American Express

- Danske Bank

- Engage

- First Direct

- HSBC

- John Lewis Finance

- M&S Bank

- Nationwide Building Society

- Santander

- Starling Bank

- The Co-operative Bank

United States

- American Express

- BB&T

- BBVA Compass

- Bank of America

- Barclaycard

- Capital One

- Chase

- Citibank

- Discover

- Fifth Third Bank

- Navy Federal Credit Union

- PNC

- Regions

- SunTrust

- Synchrony Bank

- TD Bank

- US Bank

- USAA

- Wells Fargo

Vietnam

- ABBank

- BIDV

- Citi

- FE Credit

- HDBank

- Maritime Bank

- PVCOM Bank

- Sacombank

- Saigon Commercial Bank

- SeABank

- Shinhan Bank

- TP Bank

- Techcombank

- Vietcombank

- VietinBank

- Woori Bank Vietnam

Which devices support Samsung Pay?

When Samsung Pay first launched, it was only available on their high-end Galaxy smartphones. Over time, they added support for some mid-range and budget phones too.

However, specific older models like the Galaxy S6 don't support Samsung Pay everywhere because they need the necessary NFC and MST hardware in all markets. Nonetheless, nowadays, most new Samsung phones have the required technology to use Samsung Pay in supported countries.

Here is the list of Samsung phones that can use Samsung Pay.

- Galaxy A3 (2017)

- Galaxy A5 (2016)

- Galaxy A5 (2017)

- Galaxy A51

- Galaxy A7 (2016)

- Galaxy A7 (2017)

- Galaxy A70

- Galaxy A71

- Galaxy A8 (2016)

- Galaxy A8 (2018)

- Galaxy A8 Plus (2018)

- Galaxy A8 Star (only in Hong Kong and China; also called A9 Star)

- Galaxy A80

- Galaxy A9 (2016)

- Galaxy A9 Pro

- Galaxy C5 (only in China)

- Galaxy C5 Pro (only in Hong Kong and China)

- Galaxy C7 (only in China)

- Galaxy C7 Pro (only in Hong Kong and China)

- Galaxy C9 Pro (only in Hong Kong and China)

- Galaxy F62

- Galaxy Fold

- Galaxy J5 Pro (only in some countries)

- Galaxy J7 Pro (only in some countries)

- Galaxy Note 10

- Galaxy Note 10+

- Galaxy Note 20

- Galaxy Note 20 Ultra

- Galaxy Note 5

- Galaxy Note 7 Fan Edition

- Galaxy Note 8

- Galaxy Note 9

- Galaxy S10

- Galaxy S10+

- Galaxy S10e

- Galaxy S20

- Galaxy S20 Fan Edition

- Galaxy S20 Plus

- Galaxy S20 Ultra

- Galaxy S21

- Galaxy S21 Ultra

- Galaxy S21+

- Galaxy S6 (only in some countries)

- Galaxy S6 Active

- Galaxy S6 edge (only in some countries)

- Galaxy S6 edge+ (only in some countries)

- Galaxy S7

- Galaxy S7 Active

- Galaxy S7 edge

- Galaxy S8

- Galaxy S8 Active

- Galaxy S8+

- Galaxy S9

- Galaxy S9+

- Galaxy Z Flip

- Galaxy Z Fold 2

- Samsung W2017 (only in China)

- Samsung W2018 (only in China)

Note: In some countries, these phones may only work with NFC payment terminals, not regular magnetic strip readers, as they lack MST technology. Also, Samsung Pay must be officially available in your country before using it, even if you have a supported phone model.

How to set up Samsung Pay and add your credit/debit cards

Now that you understand how Samsung Pay works, what devices it's compatible with, and how secure it is, the next step is setting it up. Don't worry; the setup process is straightforward, but here are some step-by-step instructions to make it even simpler for you. Let's get started.

- Check if the Samsung Pay app is already installed on your phone. If not, go to

Settings > About deviceorSettings > Softwareupdate and install any available updates. - Open the Samsung Pay app. The pre-installed version is incomplete, so you'll be prompted to download the full app (around 80-100MB). Once downloaded, tap "Install".

- You can watch the intro video or skip it. Then, sign in to your Samsung account. If you don't have one, create a new one. After logging in, Tap "Start", agree to the terms, and hit "Next".

- Choose a verification method: iris scanner (if available), fingerprint, or PIN. If you use an iris or fingerprint scanner, you must also set up a backup PIN.

- After choosing your preferred verification method, you will need to create a 4-digit Samsung Pay PIN.

- Now, Tap on "Add card" or the "+" sign to add your first card.

- Use the camera to scan your credit/debit card information. Enter the CVV code and name as shown on the card. Double-check that all details are correct before proceeding.

- After entering your card details, tap "Next" and wait for the app to validate the card. If asked, agree to your bank's terms and conditions.

- You'll be prompted to verify your card. Choose from the verification methods shown (this depends on your bank/card provider) and follow the app's instructions to complete verification.

- You may also need to sign your card by drawing your signature in the box provided on the screen.

- Your card has now been added to Samsung Pay and can be used to make payments anywhere that accepts credit/debit cards.

- To add more cards, tap the "+" button on Samsung Pay's main screen and repeat the verification process.

How to Make Payments using Samsung Pay

- From the home or lock screen, swipe up from the bottom of the display to open Samsung Pay. Your default debit/credit card will be shown. If you have multiple cards set up, Swipe left/right to switch between added cards.

- To enter payment mode, tap the Fingerprint or Iris button. Suppose you have Samsung Pay secured with the biometric sensor or the “PIN” button. In that case, you can enter your PIN or tap on the fingerprint sensor with your finger to activate payment mode.

- Touch the back of your phone to the payment terminal or card reader. In some cases, you may need to touch the side. You have 30 seconds to do so, but if time runs out, repeat the above step again.

- Once your card is detected, you can remove the phone from the terminal. You may be asked to enter your card's PIN on the terminal to complete payment.

- That's it! Each transaction will be stored in the Samsung Pay app for tracking. There's generally no payment limit, but your bank may set limits on your card.

Is there a Samsung Pay debit card?

Samsung has partnered with SoFi, a financial technology company based in San Francisco, to offer a new banking service called Samsung Money for customers in the United States. Samsung Money provides personal and joint cash management accounts and a physical Mastercard debit card. This new Samsung Money banking service from SoFi will only be available in the U.S. and was launched in the summer of 2020.

Does Samsung Pay work in foreign countries?

If your card and bank allow you to use that card in the country you're traveling to, you can use Samsung Pay there just like you do at home. For some cards, you may need to ask your bank ahead of time to enable usage of that card in the foreign country you plan to visit. But once your bank has enabled Samsung Pay for that travel destination, you'll be able to make payments with Samsung Pay using that card during your trip abroad.

Does Samsung Pay need an internet connection?

You don't need an internet connection to make payments at stores using Samsung Pay. Otherwise, it wouldn't be more convenient than a regular physical card. However, you can only make up to 10 transactions without internet access.

You need an internet connection to add new cards to the Samsung Pay app and to view your transaction history and details in the app.

So, while the internet isn't required for the actual in-store payments, it is necessary for initial setup, adding/managing cards, and checking your payment records in Samsung Pay.

What else can Samsung Pay do?

In addition to making payments, Samsung Pay also allows you to store membership cards, pay bills, and use PayPal in some countries. However, the specific features available depend on where you live.

For example, PayPal integration is offered in the United States, while users in India can pay utility bills like electricity and water through Samsung Pay.

You can even use Samsung Pay to make online purchases on websites that support it. Just ensure you have the latest version of the Samsung Internet browser or Google Chrome installed.

So, while Samsung Pay's core function is in-person payments, it also provides additional capabilities like loyalty cards, bill pay, and online checkout—but the exact number of extras available varies by country.

Conclusion

In this article, we learned about Samsung Pay, how to set it up, and how to use it to make payments. Samsung Pay uses NFC and MST technologies, which are widely accepted even at older payment terminals. This makes it more versatile than Google Pay and Apple Pay.

Setting up Samsung Pay is straightforward, and using it for payments is as simple as authenticating with your fingerprint, iris, or PIN and tapping your phone on the card reader.

While its availability expands globally, the specific features may vary across countries. Overall, Samsung Pay offers a convenient and secure way to make payments directly from your Samsung device, leaving your physical wallet at home.

Also Read: How to Change the Default Payment Option on Your Samsung Phones

If you've liked our article, please let us know in the Comment Section

This page may contain affiliate links so we earn a commission. Please read our affiliate disclosure for more info.

JOIN THE DISCUSSION: